Today, banks and retailers can access a huge amount of data about their customers that can be analysed and repurposed. This includes every card payment, every online order, and every in-store purchase. Within this data lies a wealth of opportunities for targeted marketing and cross-sell campaigns, initiatives that can increase customer value, boost revenue, and build long-term loyalty.

Yet many businesses still fail to take full advantage of this potential. Instead of providing products and services at the moment they are most relevant, they often use broad, “one-size-fits-all” campaigns. These generic approaches might reach a lot of people, but they rarely deliver the expected results.

This is where enriched card data and transaction data analytics make all the difference. These tools turn raw payment data into practical insights that help you understand customer behavior on a much deeper level. Armed with these insights, you can connect with customers through personalised offers that arrive at exactly the right time - delivered through the channels they already use, like their banking app.

What’s a card data enrichment?

A standard card payment doesn’t tell you much, just the amount, the date, and some cryptic version of the merchant’s name. Not exactly a goldmine for marketing or strategic decision-making.

Enrichment changes that. It adds the kind of context that makes all the difference:

- Merchant identification – the proper, full name and type of business, not just a jumble of letters from a terminal printout.

- Purchase categories & behavior – what people buy, how often they buy it, and which brands they prefer.

This means you’re no longer guessing when to reach out or what to offer. Instead, you know exactly when a customer might be interested in complementary products or services.

Why it matters for cross-selling

Traditional marketing often relies on basic demographics like age or location. That’s a start, but it can’t match the precision of real behavioral data. With enriched card data, you can:

Personalise better - Demographics say “35-year-old professional.” Enriched card data says “commutes daily, eats out twice a week, pays for streaming, and just bought hiking gear.” That difference turns a generic message into a timely offer that feels personal and useful.

Boost conversions - Enriched transaction data lets you design offers that land at the right moment - like an electronics retailer showing an accessory discount days after a customer buys a new phone. This level of contextual precision translates into more activations, higher redemption rates, and stronger engagement with both the bank and the brand.

Spend smarter - Every irrelevant impression is wasted budget. Enriched data filters that out by identifying customers unlikely to respond, so campaigns focus on high-propensity segments. Banks can avoid pushing loans to users who just repaid theirs or premium card upgrades to inactive accounts.

Think about travel insurance offered right after a flight purchase, or a credit limit increase for someone who consistently reaches their current limit. Timing and context make all the difference and enrichment provides both.

%20(1).webp)

How are banks and retailers using cross-selling

Banks and retailers now use transaction-level insight to make cross-selling both smarter and more human. Instead of generic “you might also like” suggestions, they can anticipate customer needs with near-perfect timing. Of course, both use it in a slightly different way.

Banks: Financial institutions are sitting on a pile of behavioural data, and enrichment gives it structure and meaning. This allows banks to move beyond static segmentation and tailor offers to real financial habits.

- Recommending investment products to regular savers.

- Offering insurance to customers who frequently shop online.

- Running cashback campaigns tied to specific merchants or spending patterns.

Retailers: On the retail side, enriched data turns every transaction into a signal for what to promote next. By connecting offers directly to verified spending, brands can drive conversions without relying on cookies, clicks, or guesswork.

- Suggesting matching accessories after an electronics purchase.

- Increasing foot traffic with personalised vouchers.

- Strengthening loyalty programs linked directly to payment cards.

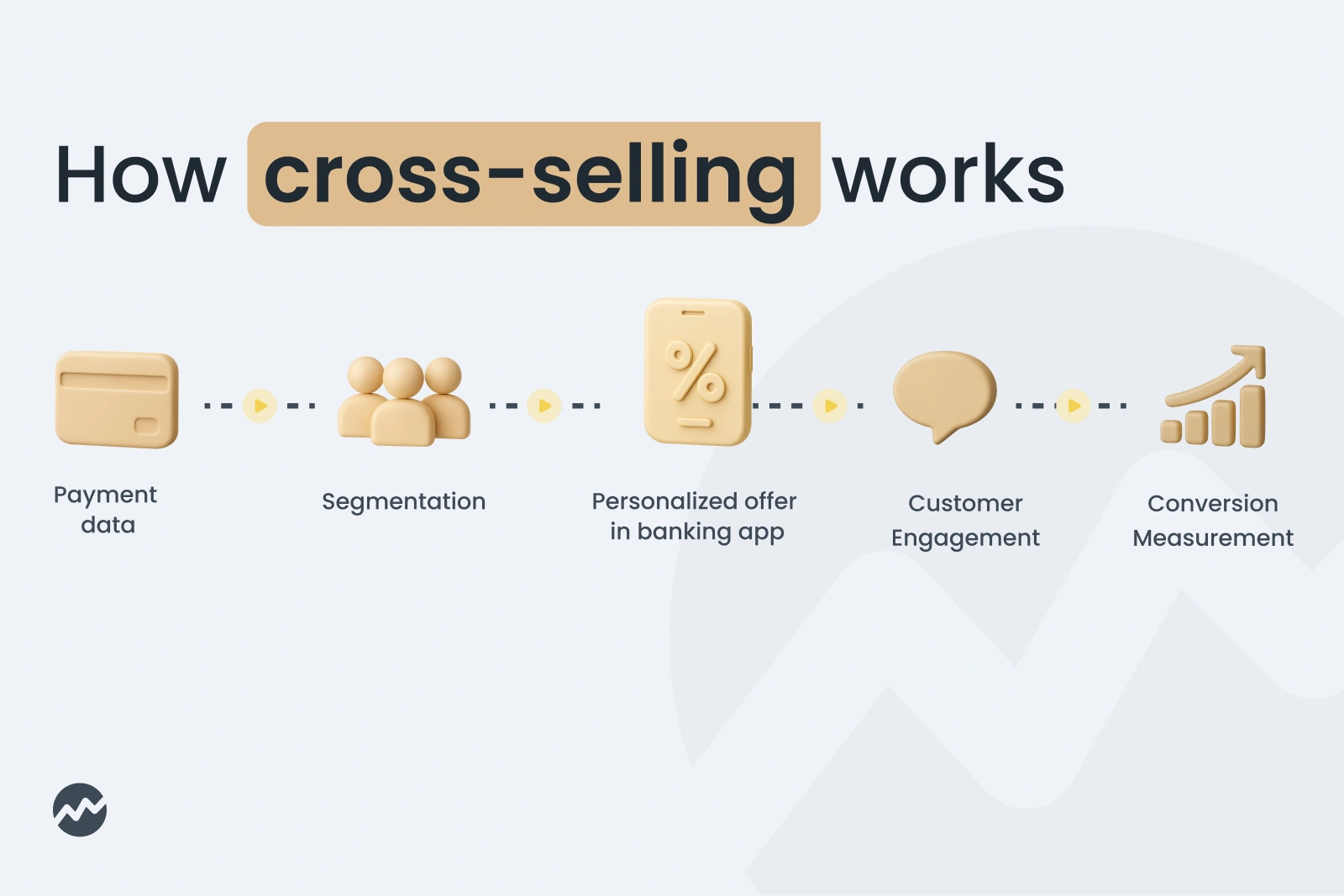

How to make it happen: Step-by-Step Guide

Look at the data – review purchase history and spending trends.

- Segment and target – group customers based on actual behavior, not assumptions.

- Create the offer – choose a relevant product and decide on the right format (cashback, voucher, exclusive discount).

- Launch it – push the offer live in the banking app or other connected channels.

- Track the results – monitor conversions, average basket size, and repeat engagement.

With Dateio Platform, this process is quick and efficient, no complex integrations, no heavy manual work, and results you can measure almost immediately.

Wrapping up

Cross-sell campaigns powered by enriched card data are becoming a core growth strategy for forward-thinking banks and retailers. By combining transaction data enrichment with proper transaction data analytics and well-timed, relevant offers, you can transform routine marketing into personalised experiences that customers value.

With Dateio Platform, it’s not only about selling more, it’s about delivering value on both sides. Customers receive offers that are relevant, timely, and useful, while businesses benefit from measurable increases in customer engagement, conversion rates, and revenue.

Want to see what it could do for you? Let’s talk!

FAQs

Enriched card data turns raw payment details into actionable insights by adding proper merchant names and purchase categories. This is key because it allows targeting based on a customer's real behaviour rather than broad demographics.

Analytics boosts conversions by enabling precise timing and relevance. The data identifies the exact moment a customer needs a complementary product (e.g., insurance after a flight purchase), replacing generic ads with timely, personalised offers that have higher redemption rates.

Banks use structured data to tailor financial offers (investments, insurance) based on a customer's real financial habits. Retailers use it to treat every purchase as a signal for the next promotion, making smarter product suggestions and driving traffic with payment-verified vouchers.

Marketing professional with B2B, fintech, e-commerce, and retail experience. She connects banks and retailers through data-driven personalization and commerce media, turning complex topics into engaging stories.